And some limited edition Cohibas.

Because that’s how we roll.

In my last post I covered the 5 passive income ideas I was following in order to see which brought the most success.

These were:

- Create YouTube videos

- Become a Udemy instructor

- Become a lender on Funding Circle

- Trade cryptocurrencies

- Create a digital product

And here’s a quick rundown of where I’m at with each right now.

1. Create YouTube videos

Although I ditched this as a passive income source in my last post, I have uploaded a few more review videos for our business Vitalife Health – they don’t get huge viewing figures, but they do get views that tend to convert, so it’s an interesting promotional avenue for this business going forwards.

It just doesn’t work for me as a passive income source – largely because in order to make money (if you don’t already have a trading business to promote), you typically have to put out regular content, and that means regular filming (and editing, if you intend to do this yourself), which ultimately means this isn’t passive.

2. Become a Udemy Instructor

Since I was already a Udemy instructor when the passive income challenge began, I set myself the challenge of creating my second course on Udemy – which I did, successfully: ‘Boost Productivity: An Entrepreneur’s Guide’

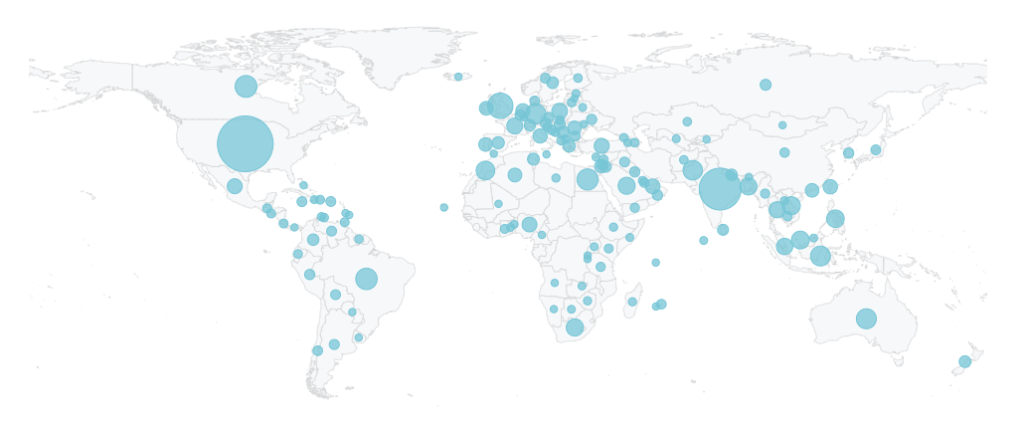

I now have just under 6,000 students across both of my courses, and a Worldwide enrolment map that looks a bit like this:

Mr Worldwide!

Yeh, not quite.

My second course still needs to pick-up a little in order to match the regular passive earning momentum that my first course now has – they are collectively drawing-in around $220 per month right now.

I may launch a third course later this year, depending how busy I become with other projects.

3. Become a lender on Funding Circle

Now, this is the area that has experienced the most significant change most recently – and one that prompted the seemingly random purchases I mentioned above (I’ll explain a little more later in this post).

Since April 2019, our returns on this platform dipped drastically due to a tranche of bad debts hitting us all at once – meaning our annual returns dipped from an already-depressed 5.2% down to a meagre 3.7%.

As I mentioned in an earlier post (Mindset Mastery: Episode 3 – How to Build Wealth Sustainably) the average rate of inflation over the past 30 years has been 3.3%. So on this basis, my money in Funding Circle was now making me just 0.4% in real terms.

Ultimately, it reached a point where the risk to my capital, and the opportunity cost of other things I could be doing with that capital, far outweighed the gains of leaving it in Funding Circle.

So I sold a chunk of our loans, and we bought some land – which, if we achieve what we want to achieve with it, should deliver anything between 15-30% annual returns. Which is far stronger than the ‘good’ returns we saw with Funding Circle in the first year, of 7.2%.

This might sound like I’ve gone 360 degrees on the whole Funding Circle investing idea – but I haven’t. If nothing else, it’s still a good short-term investment vehicle to hold funds in whilst you accumulate enough capital to do something with a greater risk/reward profile – and I’ll still be continuing to invest monthly into the platform.

Bad debts are just part and parcel of lending to small businesses – being involved in this area (small business) from a management perspective for over 15 years allows me to accept this fact perhaps better than most – and I’m certain our dip to 3.7% is just temporary.

With greater attention paid to the businesses in which we invest, and time to allow things to settle, we’ll be back to more acceptable return level for our remaining funds by the end of the year.

4. Trade cryptocurrencies

I believe Bitcoin, and the other leading crypto assets, are still massively overvalued right now, and I sense a further, steep, correction on the horizon.

So for these reasons, I think I’m stepping out of this space for good now – I do have longer term plans that incorporate cryptocurrency and I’m massively excited about the prospects and opportunities it presents, but my speculative currency-trading hat is firmly on the peg.

5. Create a digital product

My digital product was a collection of niche e-commerce sites – of which I ended-up building 3.

One in DIY products, one in pet products, and the other in the jewellery space.

If you want to know more about the process I went through to set these up, see my post Passive Income Ideas Challenge Update.

They were all working out great, generating consistent passive income using my cost-effective promotional strategy and affiliate monetisation – then the hosting company I was using (who I won’t name here as I know it wasn’t their fault, given the number of resources I was using), suspended my account.

It was shared hosting, and each of the 3 niche sites were offering upwards of 40,000 lines, so the databases were pretty vast!

I switched over to a dedicated server, to overcome the suspension, but the cost of doing this rendered the whole operation loss-making each month.

I still think this is something I want to revisit and tweak – whenever I see potential in something, I have to explore it further – but I’ll keep the range of products narrower and more focused (particularly on higher-value lines), to see if this is something you can maintain on a low-cost, shared-hosting package.

This is the only approach I can see that would maintain profitability in the long-term.

Sooo . . .

Onto the land purchase (and cigars).

My Wife Grace and I did some brainstorming, and came up with a concept that intends to generate a far stronger return than what we were generating in Funding Circle (even in our first year, when we had a return of around 7.2%).

And the idea we came up with involves owning a fair chunk of agricultural grassland (2.5 acres).

You can find this type of land fairly cheap in the UK, since developers know there’s not a chance in hell of getting residential or commercial planning permission on something like this (so your buying competition becomes a lot narrower, which drives the price down).

The sort of land we bought is pretty much of interest only to equestrian operations, campsite owners (although not in our specific case, due to some covenants that exist on the land), and select farmers.

We managed to source 2.5 acres of agricultural land for just shy of £20k.

Exactly what we have planned with this land, we cannot share at this stage – but it’ll be exciting to share more soon – we’ll be documenting the whole process in a video series, so everyone can see what’s involved and what we’re trying to achieve here.

And the cigars?

True cigar aficionados will hate me for this – but my decision to buy these was purely investment-based. I’m not interested in using them for my own enjoyment (I don’t smoke, for a start).

I watched the price performance of the Cohiba Robustos Supremos 2014 from when I could source them for £450 a case, then checking these the following year, noticed they were now priced at £1,095 a case. A pretty good annual rate of return I would say!

So I took the dive with the more recent Cohiba Talisman Limited Edition 2017, and purchased 2 cases (I won’t disclose the price on here) – planned and implemented a great storage system (super-important if you want your cigars to hold value) that holds them at 69% humidity and between 70-72 degrees Fahrenheit at all times – and will now sit on them for the next couple of years or so to see if something similar happens with the price-tag as happened to the 2014 ones.

The great thing about limited edition cigars is that they start off with very limited production quantities, and they’re mostly sought-after by cigar enthusiasts who will either purchase them with the intention of smoking them, or will be tempted to smoke them down the line.

The supply will therefore constantly diminish (and by the look of the Cohiba Robustos Supremos price trajectory, it diminishes pretty quickly!) – so it’s almost certain that well-stored units will soar in price as they become rarer and rarer.

And if both the land project and the cigar investment don’t work out?

At least we have some fine cigars and a nice view.

You don’t get that with failing stocks and shares!

My next post will explain more about our land project – stay tuned!